Bankruptcy Watch

Warning: For Full Access Please Log In or Create an Account (Free)

Most I've seen are restructurings, but we really do need a 2021 bounce back for companies to have anything left to even restructure or liquidate if things get worse.@Susan L. wrote:

I hope these companies are filing for reorganization and not liquidation. I want them to come back as the economy gets better.

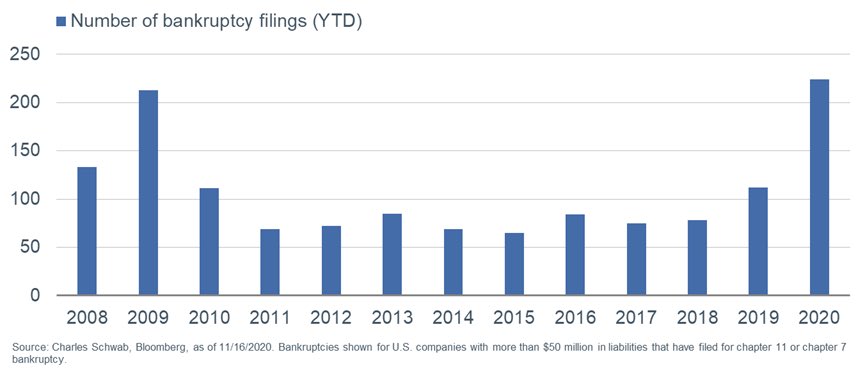

We've officially surpassed 2009 in bankruptcies. The good news is we have TWO fantastic vaccines ready to save the day. Just need to make it through to the other side.

Francesca's is closing 140 stores to try to stave off bankruptcy. [www.cnbc.com]

Some interesting facts about restaurants from Good Morning America yesterday:@ wrote:

The restaurant industry has permanently lost more than 110,000 eateries and drinking establishments in the over 200 days since the pandemic first brought operations to a halt.

As documented in the survey, the vast majority of restaurants that have permanently closed were well-established businesses and fixtures in their respective communities for an average of 16 years.

Before closing for good, those restaurants employed an average of 32 people, and 17% employed at least 50 people.

[www.goodmorningamerica.com]

End of article has some staggering statistics.

[www.yahoo.com]

...another casualty@ wrote:

A beloved clothing store with 449 locations in the U.S. has just filed for bankruptcy. On Jan. 14, Christopher&Banks announced in a statement that it had voluntarily filed for Chapter 11 bankruptcy protection and will be shuttering stores in the near future. . .

The brand, which operates women's clothing and accessories stores in 44 states, "expects to close a significant portion, if not all, of its brick-and-mortar stores," representatives for Christopher&Banks said in its statement.

Cici's (pizza) files: [www.cnbc.com]

@ wrote:

Cici’s has filed for Chapter 11 bankruptcy and announced its sale to D&G Investors.

The coronavirus pandemic has accelerated the downfall of all-you-can-eat buffets.

In bankruptcy filings, Cici’s said that it had between $10 million to $50 million in assets and $50 million to $100 million in liabilities.

Thats bad news about Cici's. It must be really scary to run a restaurant these days.

[www.freep.com]

Unfortunately, a large furniture chain is added to the list.

Unfortunately, a large furniture chain is added to the list.

________________________________________

Two wrongs don't make a right, but three lefts do.

Two wrongs don't make a right, but three lefts do.

Basically the oil and gas industry has been on suicide watch for the past year.....

So I work for a consulting firm that got bought out by a massive publicly traded consulting firm back in 2013 when I started with them. 3 of the engineers dipped and decided to startup their own firm. I’m certain it was because they lost their shot at a chance for ownership. For better clarity on how fruitful being an owner of a consulting firm: 6 owners and ~40 employees with ~$40M revenue/year for purely billable, consulting services = massive revenue shares. So they started up their firm brought a handful of guys with them, which I’m certain burnt lots of bridges, even to this day. Well, 7 years later, the oil crash was stupid catastrophic and the worst I’ve ever seen in my career. And just last week I saw they filed for Chapter 7, and wasn’t surprised. Definitely a terrible time for the oil and gas industry as a whole, even if the pay’s still well above average.

So I work for a consulting firm that got bought out by a massive publicly traded consulting firm back in 2013 when I started with them. 3 of the engineers dipped and decided to startup their own firm. I’m certain it was because they lost their shot at a chance for ownership. For better clarity on how fruitful being an owner of a consulting firm: 6 owners and ~40 employees with ~$40M revenue/year for purely billable, consulting services = massive revenue shares. So they started up their firm brought a handful of guys with them, which I’m certain burnt lots of bridges, even to this day. Well, 7 years later, the oil crash was stupid catastrophic and the worst I’ve ever seen in my career. And just last week I saw they filed for Chapter 7, and wasn’t surprised. Definitely a terrible time for the oil and gas industry as a whole, even if the pay’s still well above average.

Very infrequently shopping the Greater Denver Area, Colorado Springs and in-between in Colorado these days.

There's definitely a lot of pain in the shale oil industry.

Many were living on borrowed time already (not able to generate free cash flow, given low oil prices and high costs of operation) and any economic downturn was likely to put a lot of them out of business as junk bond issuance and private equity/bank financing dried up.

Many were living on borrowed time already (not able to generate free cash flow, given low oil prices and high costs of operation) and any economic downturn was likely to put a lot of them out of business as junk bond issuance and private equity/bank financing dried up.

If you have a high tolerance for risk, there are some REITs (Real Estate Investment Trusts) that have plummeted in stock market value. I expect that the well-run ones will recover before going bankrupt, but you have to like roller coaster rides. For instance, Washington Prime Group (WPG) used to pay high dividends, then it lost most of its value (and all of the dividends) last year and recently did a 9:1 reverse split. There was a point where a drink at Starbucks would have bought 10 shares of WPG. As the old Chinese proverb says, "May you live in interesting times."

Shopping Southeast Pennsylvania, Delaware above the canal, and South Jersey since 2008

I am not very knowledgeable about REITs, but have indirect exposure to STORE Capital in my Berkshire Hathaway stock. I know they are great investment vehicles for Roth IRAs.@myst4au wrote:

If you have a high tolerance for risk, there are some REITs (Real Estate Investment Trusts) that have plummeted in stock market value. I expect that the well-run ones will recover before going bankrupt, but you have to like roller coaster rides. For instance, Washington Prime Group (WPG) used to pay high dividends, then it lost most of its value (and all of the dividends) last year and recently did a 9:1 reverse split. There was a point where a drink at Starbucks would have bought 10 shares of WPG. As the old Chinese proverb says, "May you live in interesting times."

I do wonder about commercial real estate. It must be scary, as we've seen a mass urban exodus and lots of companies saying they are interested in extending work-from-home (full or semi-) for a while to see how it'd work. There's talk of the death of commercial districts. Although, a great contrarian investor may find opportunity there.

With more suburban, strip-mall types of real estate, I think there is lots of light at the end of the tunnel. With multiple vaccines being distributed, I can see a return to some sense of normalcy by year-end.

With more suburban, strip-mall types of real estate, I think there is lots of light at the end of the tunnel. With multiple vaccines being distributed, I can see a return to some sense of normalcy by year-end.

NYC has been exploring ways to give a tax break for converting commercial buildings into residential housing. There is always a shortage of housing here. And because of covid isolation/lockdowns, companies are leasing less office space since staff are working from home.

I saw a funny comment on the supposed "death of commercial real estate."

Never underestimate a husband's desire to get away from his wife (or vice versa) in bringing back in-office work. . . .I think even for productivity reasons, there may be a need to be in an office. As a graduate student, one of my colleagues would say: "I don't trust myself working on my dissertation work at the apartment. I have to be on campus to get things done." ...Sometimes there's just a lot of "cheating" opportunities when you're working from home. You can take those web-surfing breaks that run on much longer than expected with no one monitoring you.

. . .I think even for productivity reasons, there may be a need to be in an office. As a graduate student, one of my colleagues would say: "I don't trust myself working on my dissertation work at the apartment. I have to be on campus to get things done." ...Sometimes there's just a lot of "cheating" opportunities when you're working from home. You can take those web-surfing breaks that run on much longer than expected with no one monitoring you.

I tend to believe things will return to pre-COVID norms, but who knows.

Never underestimate a husband's desire to get away from his wife (or vice versa) in bringing back in-office work.

. . .I think even for productivity reasons, there may be a need to be in an office. As a graduate student, one of my colleagues would say: "I don't trust myself working on my dissertation work at the apartment. I have to be on campus to get things done." ...Sometimes there's just a lot of "cheating" opportunities when you're working from home. You can take those web-surfing breaks that run on much longer than expected with no one monitoring you.

. . .I think even for productivity reasons, there may be a need to be in an office. As a graduate student, one of my colleagues would say: "I don't trust myself working on my dissertation work at the apartment. I have to be on campus to get things done." ...Sometimes there's just a lot of "cheating" opportunities when you're working from home. You can take those web-surfing breaks that run on much longer than expected with no one monitoring you.

I tend to believe things will return to pre-COVID norms, but who knows.

Sick and twisted exploitative capitalism at work here:

[twitter.com] (Janie Velencia Twitter thread)

Edited 1 time(s). Last edit at 03/05/2021 10:19PM by shoptastic.

[twitter.com] (Janie Velencia Twitter thread)

private equity doing its dirty business. . .@ wrote:

If you're just tuning in,

@Paper_Source

declared bankruptcy this week. But before they did that, they put in lots of large orders with over 250 small independent companies knowing that they wouldn't have to pay for the inventory after the fact. THREAD

After a very difficult year, wholesalers like myself thought retail was finally getting its second wind. And we all eagerly accepted PS’s orders ranging from $5,000 to as much as $60,000 and worked overtime to get them out fast by their expedited deadlines.

For my business, Paper Source ordered more in a 60 day period than they did in all of 2020. And this is true for many others in the industry. Again, they did this to cook their books at our expense.

Why order product they can't pay for? Because they're using all of our inventory as liquidation income and assets to look better to venture capital firms they're trying to sell to. They made poor business decisions but small businesses will suffer while they get a buyout.

What

@Paper_Source

is doing is doing to small stationery companies is fraud yet it’s all perfectly legal. They are too big to fail.

Terms of bankruptcy say we might get paid on orders placed 20 days prior. Small business will be the last in line after everyone else they owe money to. It could take years for payouts to be made and in the end we may not see a penny.

For orders older than 20 days, their bankruptcy terms don’t outline any recourse. Meaning that there’s no possibility of seeing any of those payments.

Edited 1 time(s). Last edit at 03/05/2021 10:19PM by shoptastic.

That sounds like a Rico statute violation and just might involve your state's attorney general along with the FBI. You might want to send a letter to them, and see if they can do anything.

@shoptastic wrote:

Sick and twisted exploitative capitalism at work here:

[twitter.com] (Janie Velencia Twitter thread)

private equity doing its dirty business. . .@ wrote:

If you're just tuning in,

@Paper_Source

declared bankruptcy this week. But before they did that, they put in lots of large orders with over 250 small independent companies knowing that they wouldn't have to pay for the inventory after the fact. THREAD

After a very difficult year, wholesalers like myself thought retail was finally getting its second wind. And we all eagerly accepted PS’s orders ranging from $5,000 to as much as $60,000 and worked overtime to get them out fast by their expedited deadlines.

For my business, Paper Source ordered more in a 60 day period than they did in all of 2020. And this is true for many others in the industry. Again, they did this to cook their books at our expense.

Why order product they can't pay for? Because they're using all of our inventory as liquidation income and assets to look better to venture capital firms they're trying to sell to. They made poor business decisions but small businesses will suffer while they get a buyout.

What

@Paper_Source

is doing is doing to small stationery companies is fraud yet it’s all perfectly legal. They are too big to fail.

Terms of bankruptcy say we might get paid on orders placed 20 days prior. Small business will be the last in line after everyone else they owe money to. It could take years for payouts to be made and in the end we may not see a penny.

For orders older than 20 days, their bankruptcy terms don’t outline any recourse. Meaning that there’s no possibility of seeing any of those payments.

Janie (per the thread) is looking into things with VA's attorney general, et. al. . . .I'm not sure anything can be done, 2stepps, but it'll be interesting to track.@2stepps wrote:

That sounds like a Rico statute violation and just might involve your state's attorney general along with the FBI. You might want to send a letter to them, and see if they can do anything.

They sometimes call private equity, pirate equity.

eta: Looks like the story made Bloomberg news: [www.bloomberg.com]

Edited 1 time(s). Last edit at 03/06/2021 07:59PM by shoptastic.

If they did it knowingly, it could be bankruptcy fraud.

For those who have time...bored...interested...this was a good article back in February ("The Golden Age of White Collar Crime" ):@Susan L. wrote:

If they did it knowingly, it could be bankruptcy fraud.

[www.huffpost.com]

It begins:

It's pretty hard to prosecute and nail crimes on the rich. So many are political donors, well-connected, and do things the are just within the fuzzy boundaries of legality/illegality. There's a seemingly true, but funny saying that the only time the rich are prosecuted and punished for their schemes are when the victims are wealthy, as in the Bernie Madoff case. Scam the poor or working-class (in this case, small businesses) and you may get a small fine and slap on the wrist.@ wrote:

OVER THE LAST TWO YEARS, nearly every institution of American life has taken on the unmistakable stench of moral rot. Corporate behemoths like Boeing and Wells Fargo have traded blue-chip credibility for white-collar callousness. Elite universities are selling admission spots to the highest Hollywood bidder. Silicon Valley unicorns have revealed themselves as long cons (Theranos), venture-capital cremation devices (Uber, WeWork) or straightforward comic book supervillains (Facebook). Every week unearths a cabinet-level political scandal that would have defined any other presidency. From the blackouts in California to the bloated bonuses on Wall Street to the entire biography of Jeffrey Epstein, it is impossible to look around the country and not get the feeling that elites are slowly looting it.

And why wouldn’t they? The criminal justice system has given up all pretense that the crimes of the wealthy are worth taking seriously. In January 2019, white-collar prosecutions fell to their lowest level since researchers started tracking them in 1998. Even within the dwindling number of prosecutions, most are cases against low-level con artists and small-fry financial schemes. Since 2015, criminal penalties levied by the Justice Department have fallen from $3.6 billion to roughly $110 million. Illicit profits seized by the Securities and Exchange Commission have reportedly dropped by more than half. In 2018, a year when nearly 19,000 people were sentenced in federal court for drug crimes alone, prosecutors convicted just 37 corporate criminals who worked at firms with more than 50 employees.

With few exceptions, the only rich people America prosecutes anymore are those who victimize their fellow elites.

Maybe the publicity this is getting will help in a potential lawsuit. Public pressure can sometimes force some hands.

Edited 2 time(s). Last edit at 03/10/2021 01:05AM by shoptastic.

Sorry, only registered users may post in this forum.